EFAMA urges changes to MBI implementation timetable

Following the publication of the European Commission report confirming the settlement discipline regime will be reviewed, Susan Yavari, Regulatory Affairs Adviser at EFAMA, says concerns

Following the publication of the European Commission report confirming the settlement discipline regime will be reviewed, Susan Yavari, Regulatory Affairs Adviser at EFAMA, says concerns

By Vic Leverett, head of Alternative Investments at Russell Investments.

By A Paris — From the appeal of no income tax, to the supportive business community and the weather and lifestyle it offers, Florida has continued

EFAMA has published its response to the European Commission’s targeted consultation on the supervisory convergence and the Single Rule Book, focusing on three areas for

Ahead of the close of TPR’s consultation (on Wednesday 26 May) on a new single code of practice for pension schemes, Jay Solanki, Head of

Judith Hartley, CEO of British Patient Capital, comments on the lack of UK institutional fund flow to venture capital. Scale Up Week is a reminder

DC default funds should follow DB schemes and insurance companies in moving away from passive corporate bond allocations to improve climate resilliance and member outcomes,

Anton Chashchin (pictured), Managing Partner at CEX.IO Prime Trading, explores how the launch of central bank-issued digital currencies (CBDCs) – including a sterling-based ‘britcoin’ –

The Pensions and Lifetime Savings Association (PLSA) has commented on the Government’s intention to extend the Taskforce for Climate Related Financial Disclosures. Joe Dabrowski, Deputy

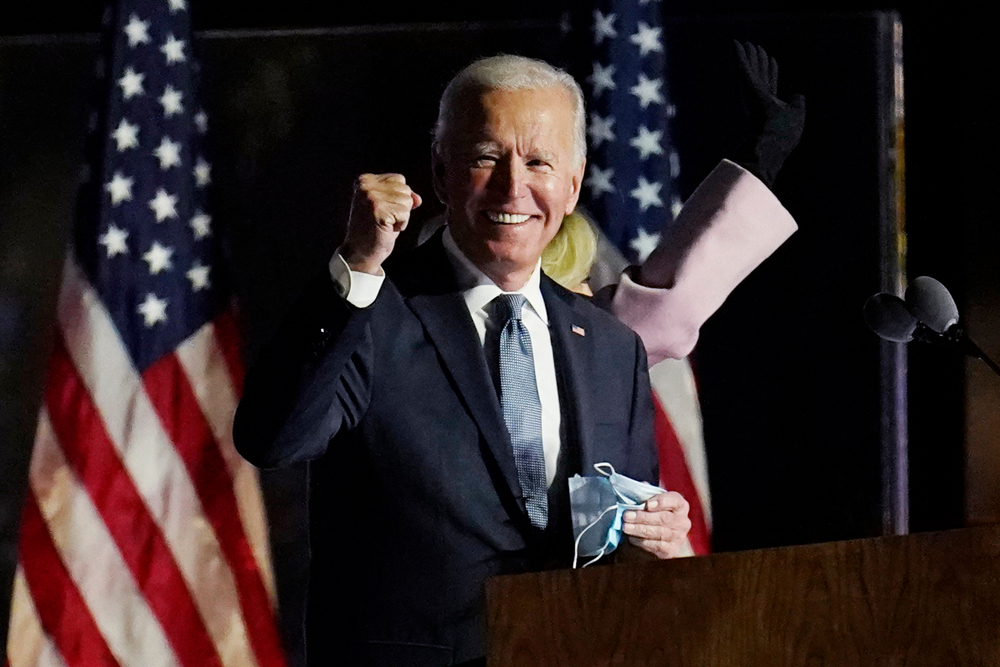

As Joe Biden’s presidency passes the 100-day mark, fund managers are considering what impact his inaugural period in office will have on financial markets. A

© 2022 Institutional Asset Manager