Impact funds tackle housing crisis

Schroders, Man Group and Resonance have committed GBP550 million through impact funds which the government says: “Will directly tackle the most acute housing crisis in living memory”.

Schroders, Man Group and Resonance have committed GBP550 million through impact funds which the government says: “Will directly tackle the most acute housing crisis in living memory”.

A survey of UK pension funds and insurers that collectively oversee GBP359.82 billion in assets, commissioned by AlphaReal, the specialist manager of secure income real assets, found that 90 per cent plan to increase their allocation to renewable energy in the next 12 months, while the remaining 10 per cent say they might make increases.

The firm writes that the new fund benefits from synergies of BNP Paribas’ diversified model: close collaboration between BNP Paribas Asset Management, BNP Paribas Corporate & Institutional Banking and BNP Paribas Cardif.

Sustainable infrastructure is proving an attractive asset class for long-term investors with an eye on the green transition. According to figures from the Bloomberg New Energy Finance Renewable Energy Investment Tracker, in the first six months of 2023, investors channelled USD358 billion of new capital to renewable energy projects.

Benjamin Morton, head of global infrastructure at Cohen & Steers writesthat investors’ search for diversification and inflation protection has put a spotlight on infrastructure, made brighter by massive public investment programs and the accelerating transition to a digitised, decarbonised economy.

Pantheon Infrastructure PLC, the listed global infrastructure fund, has committed to invest approximately GBP35 million in battery storage and electric vehicle fleet specialist Zenobe, through a co-investment vehicle managed by Infracapital, a leading European infrastructure investor that has raised and managed over GBP7 billion in assets.

Preqin has published its Infrastructure Q2 2023 report which finds that infrastructure assets have performed well, while the fund raising market is slowing.

Nick Evans writes that BlackRock is establishing a perpetual infrastructure investing strategy that will seek to partner with leading infrastructure businesses over the long term

Macquarie Asset Management, one of the world’s key investors in infrastructure and real assets, has announced the final close of its third Asia-Pacific regional infrastructure

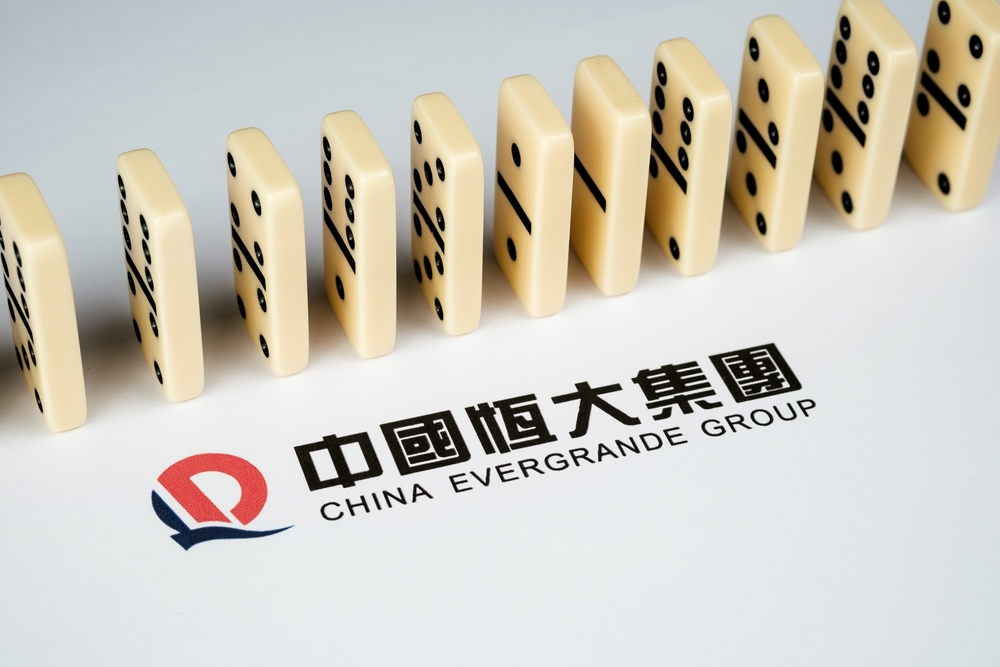

Investors are considering the future for allocations toward Chinese and Asian assets, including bonds and equities, as China’s heavily-indebted Evergrande sparks fears over the health

© 2022 Institutional Asset Manager